income tax rates 2022 uk

The 202122 tax year started on 6th April 2021 and will run until 5th April 2022. Income Tax Calculator is the only UK tax calculator that is EASY to use FREE.

57 000 Income Tax Calculator Texas Salary After Taxes Impuesto Sobre La Renta Calculadora Impuesto

This is your personal tax-free allowance.

. 10 0 from 2015 to. We have put together this quick guide to help you understand the personal income tax rates allowances and reliefs that may be available to you. In England Wales and Northern Ireland the basic rate is paid on taxable income over the Personal Allowance to 37700.

ITR 2 Salary Break-up AY 2019-20 Details for New ITR-2 Filing. Income after allowances 2022 to 2023 Income after allowances 2021 to 2022 Income after allowances 2020 to 2021 Income after allowances 2019 to 2020. In April 2019 the UK government reduced the 3 rates of Income Tax paid by Welsh taxpayers as illustrated in the below diagram.

This means you do not have to file a state income tax return unless you own a business or receive a portion of your income from rental properties. Basic rate 10 1 37699 Higher rate 37700 150000 Additional rate Above 150000 References. Your bracket depends on your taxable income and filing status.

Income taxes in Scotland are different. Rates and Who Pays in 2021-2022. The tax rates and bands table has been updated.

Income between 12571 and 50270 - 20 income tax. From 6 April 2019 the UK government reduced the three rates of UK income tax basic higher and additional paid by people in Wales 10p. Income Tax Slab Tax Rates in India for FY 2021-22 FY 2022-23 - Latest income tax slabs and rates as per the union Budget 2022 presented on February 1st 2022.

These income tax bands apply to England Wales and Northern Ireland for the 2022-23 2021-22 and 2020-21 tax years. Each year the Welsh Government decides the Welsh rates of income tax which are added to the reduced UK rates. Income up to 12570 - 0 income tax.

With effect from 1 April 2018 a two-tiered profits tax rates regime applies. 0 - 37700 20 37700 - 150000 40 150000 45. 10 12 22 24 32 35 and 37.

Choose your province or territory below to see the combined Federal ProvincialTerritorial marginal tax rates. Your tax bracket depends on your taxable income and your filing status. Visit GOVUK to let HMRC know of any changes to your address details.

Historical personal income tax rates and brackets. The current income tax rates in the UK are 20 basic rate 40 higher rate and 45 additional rate. 10 12 22 24 32 35 and 37.

There are seven tax brackets for most ordinary income for the 2021 tax year. Choosing to vary these rates or keep them the same as those paid by English and Northern Irish taxpayers. More information on Income Tax and allowances.

Calculate your salary take home pay net wage after tax PAYE. Read here to know the breakup of salary. Canada - Federal tax rates.

Find out which rate you pay and how you can pay it. Starting rate for savings. Find out more about the policy for Scottish Income Tax in 202223 on govscot.

UK Income Tax rates and bands 202223. There are seven federal tax brackets for the 2021 tax year. 13 April 2022.

Basic rate band values for England Northern Ireland and Wales have been corrected from 37000 to 37700. Florida state taxes 2021-2022. Income Tax Calculator uses UK tax brackets and personal allowance thresholds which are verified to HMRCs rates and.

The Two-Tier Profits Tax Rates Regime effective from Year of Assessment 201819. Taxable income Low income tax offset from 2022 to 2023 18200 37000 700 37001 45000 700 minus 5c for every 1 above 37000 45001 66667. Tax Rates- Marginal Personal Income Tax Rates for 2022 and 2021 2022 2021 Tax Brackets and Tax Rates - Canada and ProvincesTerritories.

ITR 2 has been recently updated by the Income Tax Department for FY 2018-19. Visit GOVUK for more information on Income Tax including. Income Tax on savings interest.

New York State Income Tax. The two-tiered profits tax regime applies to both corporations and unincorporated businesses by lowering the tax rate for the first 2 million of assessable profits. Find out more in our guide to income taxes in Scotland.

The two-tier profits. For taxpayers based in Scotland rates and allowances for Scottish Income Tax may be found here.

25 000 After Tax 2021 Income Tax Uk

Tax Burden Soared Under Moon Administration

Tax Calculator Income Tax Tax Preparation Tax Brackets

Rental Property Income Expense Tracker 5 Unit Single Etsy In 2022 Being A Landlord Profit And Loss Statement Expense Tracker

The Salary Calculator Income Tax Calculator Salary Calculator Income Tax Salary

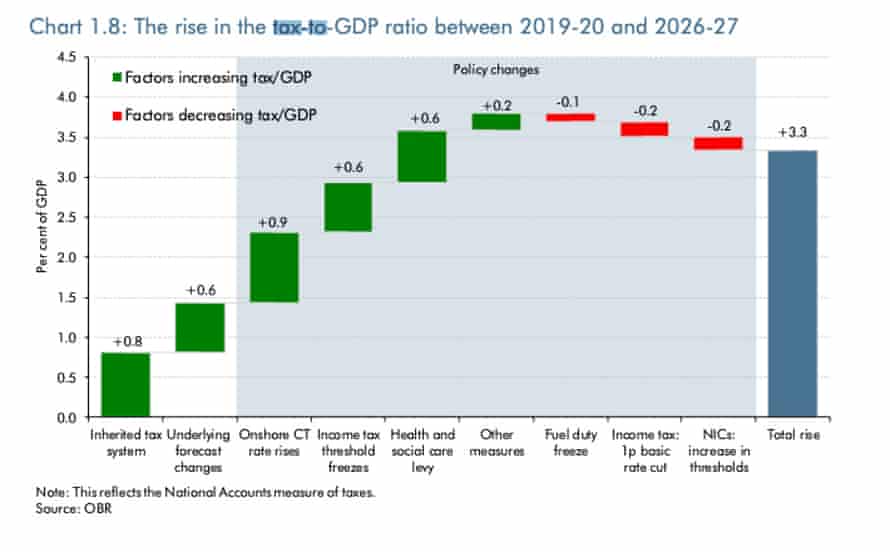

Spring Statement 2022 Living Standards Set For Historic Fall Says Obr After Sunak Mini Budget As It Happened Politics The Guardian

Income Tax And Ni Basics 2020 Income Tax Income Business Infographic

It S Very Common That Your Current Employer Will Never Provide You P45 Payslips In Case You Leave The Current Tax Forms Income Tax National Insurance Number

30 000 After Tax Uk Breakdown June 2022 Incomeaftertax Com

Progressive Tax Explained Raisin Uk

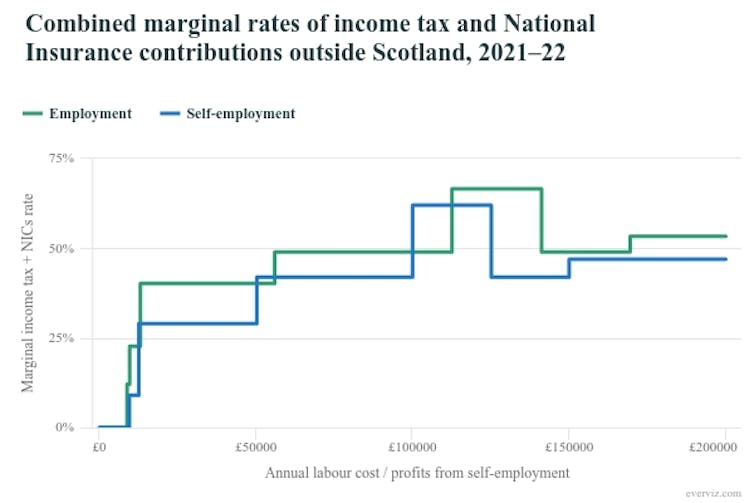

National Insurance A Uk Tax Which Is Complex And Vulnerable To Political Intervention